Accelerate your A/B testing with a targeted strategy based on Customer Experience data

Read moreMap your market

Navigate to online success

Decipher customer behavior, outpace competitors and maximize your impact. Online success starts with a clear understanding of the market.

Top brands trust WUA:

Without a view of the market you lose the match

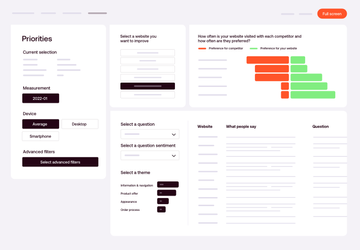

Your competition is just a mouse click away. So what do your visitors really care about? What is your competition not doing well? What can you improve to increase conversion? Only when you see the entire playing field can you as a team determine the winning strategy and offer the very best experience.

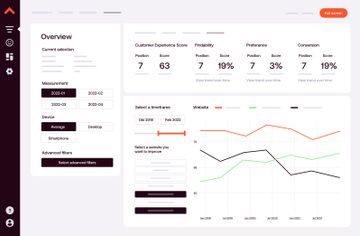

Track your market

400 potential customers explore your online market every quarter. We measure all KPIs, trends and developments and translate them into insights and action points. This way you stay ahead of your competition.

Dive into the details

200 potential customers compare your website with that of 3 competitors. We map out their entire customer journey in detail so that the why behind the market image becomes clear. This is how you make the improvements that will take your position.

The e-commerce game is won with real insights

Don't just look at the performance of your own site. Get to know your competitors better than they know themselves. This is how CX benchmarking works.

Whitepaper: Winning Tactics from Market Leaders in Retail

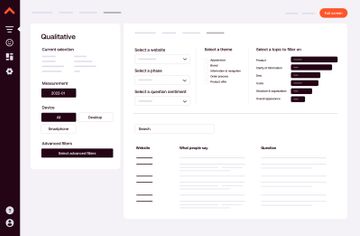

Get your copyGo beyond analytics. Way beyond.

You already know your conversion rate – and all the rest. Now you can understand the story behind customer behavior with detailed qualitative feedback.

Zoom-in to the single-customer level – and find out what works, what doesn’t, and why they choose a competitor over you.

Use in-depth and detailed qualitative feedback to help you provide thrilling website experiences for your customers, and turn a streamlined CX into killer sales.

Grow faster than the market

- Gain a profound understanding of the key investments driving significant growth in your online sales.

- Attain a comprehensive overview of the dynamic digital landscape, enabling early detection of potential threats.

- Assess customer conversion rates with precision and measure your performance against competitors effectively.